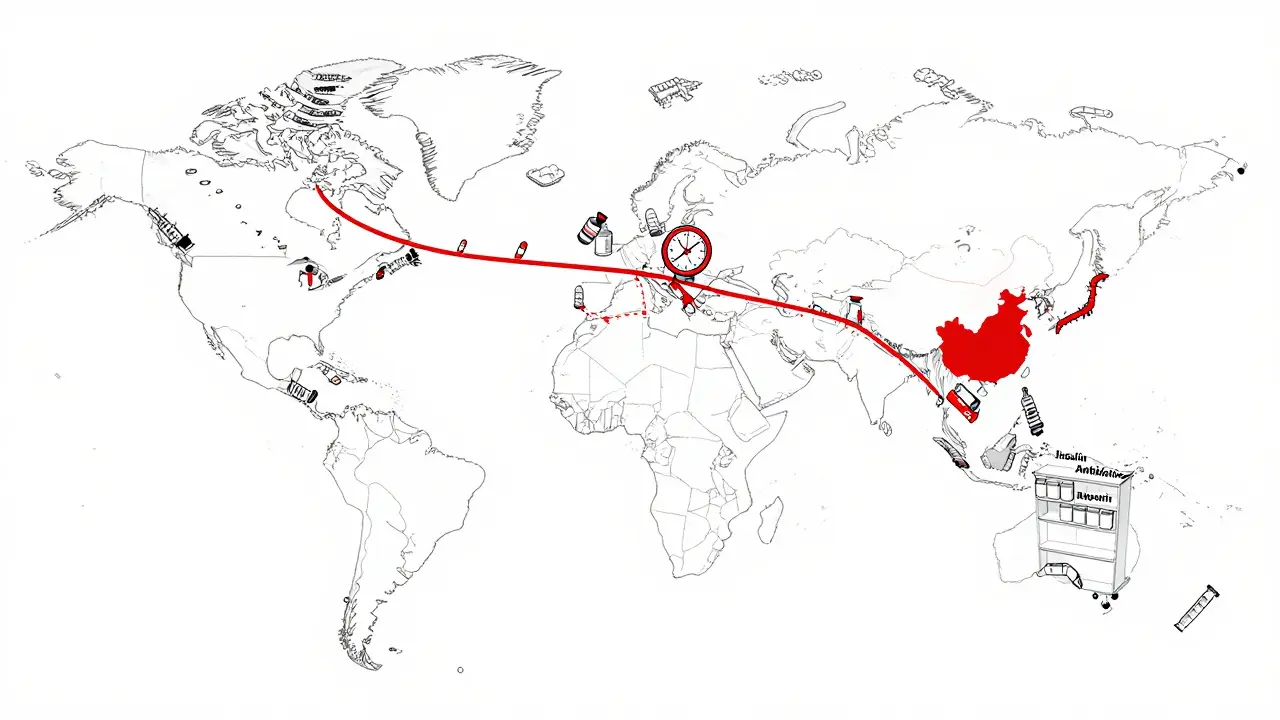

When you pick up a prescription for antibiotics, insulin, or even a common painkiller, you might assume it was made somewhere nearby. But the truth is, more than 80% of the active ingredients in U.S. medications come from just two countries: China and India. And that dependence isn’t just a footnote in a trade report-it’s the reason you’re running out of your medication, waiting weeks for a refill, or being told your doctor’s prescribed drug is simply unavailable.

How Did We Get Here?

The shift toward global pharmaceutical manufacturing didn’t happen overnight. In the 1990s and early 2000s, U.S. and European drug companies started outsourcing production to cut costs. Why? Because making active pharmaceutical ingredients (APIs) in China or India was up to 70% cheaper than doing it domestically. Labor was cheaper, environmental regulations looser, and scale was massive. By 2025, China alone produces 40% of the world’s APIs, and India handles another 40%-mostly for generic drugs. Together, they supply nearly every pill, capsule, and injection you’ve ever taken. This model worked fine as long as shipping lanes stayed open and trade policies stayed stable. But when the pandemic hit, borders closed, ports backed up, and suddenly, hospitals ran out of basic drugs like propofol and heparin. The U.S. didn’t have enough domestic capacity to fill the gap. And it wasn’t just a one-time crisis. Since then, supply chain disruptions have become routine. In 2024, a single port strike in Shanghai delayed shipments of asthma inhalers for six weeks. A cyclone in India shut down three API factories at once. A new U.S. tariff on Chinese chemicals spiked the cost of antiviral ingredients by 200%.The Real Cost of Cheap Medicine

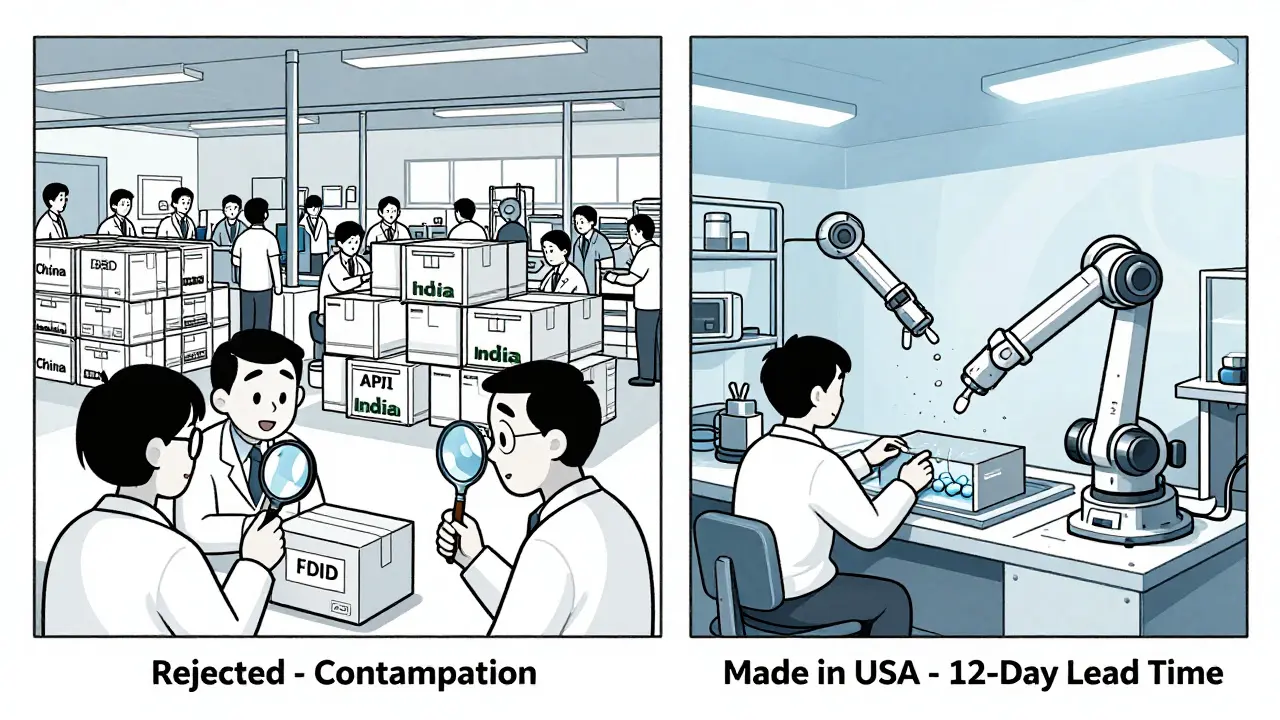

The savings look good on a balance sheet. But when a patient can’t get their heart medication because the API was stuck in a Shanghai warehouse, the cost isn’t just financial-it’s life or death. A 2025 report from the National Foreign Trade Council found that 56% of pharmaceutical companies have had to delay or cancel drug launches due to supply chain issues. That’s not a minor inconvenience. It’s a public health emergency. The FDA tracks over 400 drug shortages each year, and more than 70% of them trace back to foreign manufacturing disruptions. Insulin, antibiotics, chemotherapy agents, even common blood pressure pills-they’re all vulnerable. The problem isn’t just delays. It’s quality. In 2023, the FDA flagged 140 API shipments from India and China for contamination, improper labeling, or falsified documentation. One batch of heparin was found to contain a toxic additive that caused fatal reactions. The FDA can’t inspect every factory overseas. There aren’t enough inspectors. And many foreign suppliers lack the digital systems needed for real-time traceability.

Who’s Fixing It-and How?

Some companies are waking up. A Fortune 500 medical device maker in 2024 shifted production of critical components from China to Mexico. Result? On-time delivery jumped from 78% to 99.2%. Transportation costs dropped 35%. And they cut their lead time from 45 days to 12. That’s the power of nearshoring. Mexico, Vietnam, and even Poland are emerging as alternatives. But it’s not easy. Setting up a new manufacturing line takes 18 to 24 months. It costs 22% of your annual procurement budget. And labor in Mexico is 15-20% more expensive than in China. Still, for life-saving drugs, that trade-off is starting to make sense. Another solution? Multi-shoring. Instead of relying on one country, companies are splitting production across three or four. One drugmaker now sources its API from China for volume, India for cost efficiency, and Germany for quality control. It’s more complex, but it reduces risk. Companies using this strategy saw 65% fewer disruption days in 2025 than those still tied to single-source suppliers. Then there’s technology. AI-driven forecasting now helps predict shortages before they happen. Digital twins simulate supply chain flows so companies can test disruptions virtually. Blockchain is being used to track APIs from factory to pharmacy, reducing fraud and improving transparency. And microfactories-small, automated production units-are being piloted in the U.S. to make high-demand generics on-site. They’re expensive upfront (40% more than traditional setups), but they can respond to demand spikes in days, not months.The Bigger Picture: Trade Wars, Tariffs, and Tensions

It’s not just about logistics. It’s politics. Since 2024, the U.S. has added 12 new tariff categories targeting $340 billion in imported goods-including pharmaceutical chemicals. That’s meant higher costs for drugs, but it’s also pushed some manufacturers to move. India responded with its own tariffs on U.S. medical equipment. China restricted exports of rare earth metals used in drug packaging machines. Experts like Dr. Susan Lund from McKinsey say geopolitical distance-the average distance between trading partners-has shrunk by 7% since 2017. That’s not because we’re becoming more connected. It’s because we’re deliberately pulling back. Companies are choosing neighbors over distant suppliers. The U.S.-Mexico-Canada Agreement is being renegotiated to lock in stable tariffs. The EU is pushing for regional drug production hubs. Even Japan is investing in domestic API manufacturing for the first time in decades. But not everyone agrees. Professor Richard Baldwin from IMD Business School warns that reshoring is economically unrealistic. He points out that U.S. manufacturing wages are 4.8 times higher than China’s. Rebuilding a domestic pharmaceutical industry would raise drug prices across the board. And for patients already struggling to afford prescriptions, that’s not a solution-it’s a crisis.

What This Means for You

If you’re taking a daily medication, here’s what you need to know:- Your drug might be made overseas-and that’s normal. But if it’s a critical, life-sustaining drug, ask your pharmacist: Where is the active ingredient made?

- Keep a 30-day supply on hand. If your pharmacy runs out, don’t wait. Call other pharmacies or ask your doctor about alternatives.

- Ask if there’s a generic version from a different manufacturer. Sometimes, switching brands can bypass a shortage.

- Stay informed. The FDA maintains a public list of drug shortages. Bookmark it.

What’s Next?

The good news? Change is happening. In 2025, 78% of pharmaceutical companies are diversifying their supplier base. 68% are using AI to manage inventory. 40% of Asian-based manufacturers are already shifting to multi-shoring. The government is starting to fund domestic API production through the $1.2 billion Pharmaceutical Supply Chain Initiative. But progress is slow. It takes years to build a factory. It takes trust to switch suppliers. And it takes political will to prioritize health over cheap prices. The future won’t be all domestic or all foreign. It’ll be balanced. Distributed. Resilient. And if we get it right, no one will have to wait for their next pill because the world got too interconnected to fail.Why are so many drugs made in China and India?

China and India became the go-to sources for pharmaceutical manufacturing because they could produce active ingredients at a fraction of the cost. Labor is cheaper, regulations less strict, and infrastructure is built for massive scale. By 2025, China supplies 40% of the world’s active pharmaceutical ingredients (APIs), and India supplies another 40%. For generic drugs-used by millions-it’s simply the most economical option.

How do supply chain issues cause drug shortages?

Drug shortages happen when the raw materials (APIs) can’t reach the final manufacturer. A port strike, a natural disaster, a tariff increase, or a factory shutdown overseas can delay shipments for weeks. Since most U.S. drugmakers don’t keep large stockpiles (they rely on just-in-time delivery), even a 10-day delay can mean empty shelves. In 2024, a single shipping disruption in Shanghai caused a six-week shortage of asthma inhalers across the U.S.

Are drugs made overseas less safe?

Not necessarily-but the risk is higher. The FDA inspects only a small fraction of overseas factories each year. In 2023, over 140 shipments of APIs from China and India were rejected for contamination, mislabeling, or falsified data. Quality control systems vary widely. Some factories meet U.S. standards. Others don’t. Digital tracking tools like blockchain are helping, but they’re not yet universal.

What’s being done to fix this?

Companies are diversifying suppliers, moving production closer to home (nearshoring to Mexico, Vietnam), and investing in AI and digital twins to predict disruptions. The U.S. government launched a $1.2 billion initiative to rebuild domestic API production. Some manufacturers are using microfactories-small, automated units that can produce critical drugs on-demand. These changes take time, but they’re already reducing disruptions.

Should I avoid drugs made in China or India?

No. Most FDA-approved drugs from these countries are safe and effective. The issue isn’t the country-it’s the lack of backup. If your medication is critical and you’ve had shortages before, ask your doctor or pharmacist about alternatives from different manufacturers. Having options gives you more control when supply chains break down.

Can the U.S. make all its own drugs?

Technically, yes-but it would be extremely expensive. U.S. manufacturing wages are nearly five times higher than in China. Building new factories and retraining workers would cost tens of billions. It’s not practical to bring everything home. The smarter path is a balanced mix: keep some production overseas for cost, but build domestic capacity for critical drugs like insulin, antibiotics, and cancer treatments.

How can I help reduce drug shortages?

Don’t hoard medications. Only take what you need. Ask your pharmacist if there’s an alternative brand or generic. Support policies that fund domestic API production. And if you’re a patient with a chronic condition, keep a 30-day supply on hand. Your awareness and preparedness help reduce pressure on an already strained system.

10 Comments