When you pick up a prescription, do you ever check the label to see if it’s the brand name or the generic? For most people, it doesn’t matter-until it does. A patient might switch from brand-name Lipitor to generic atorvastatin and suddenly feel like something’s off. Their cholesterol hasn’t changed, but their perception has. And that perception? It’s what drives whether they keep taking the medicine-or stop altogether.

Why Patients Question Generics, Even When They Work

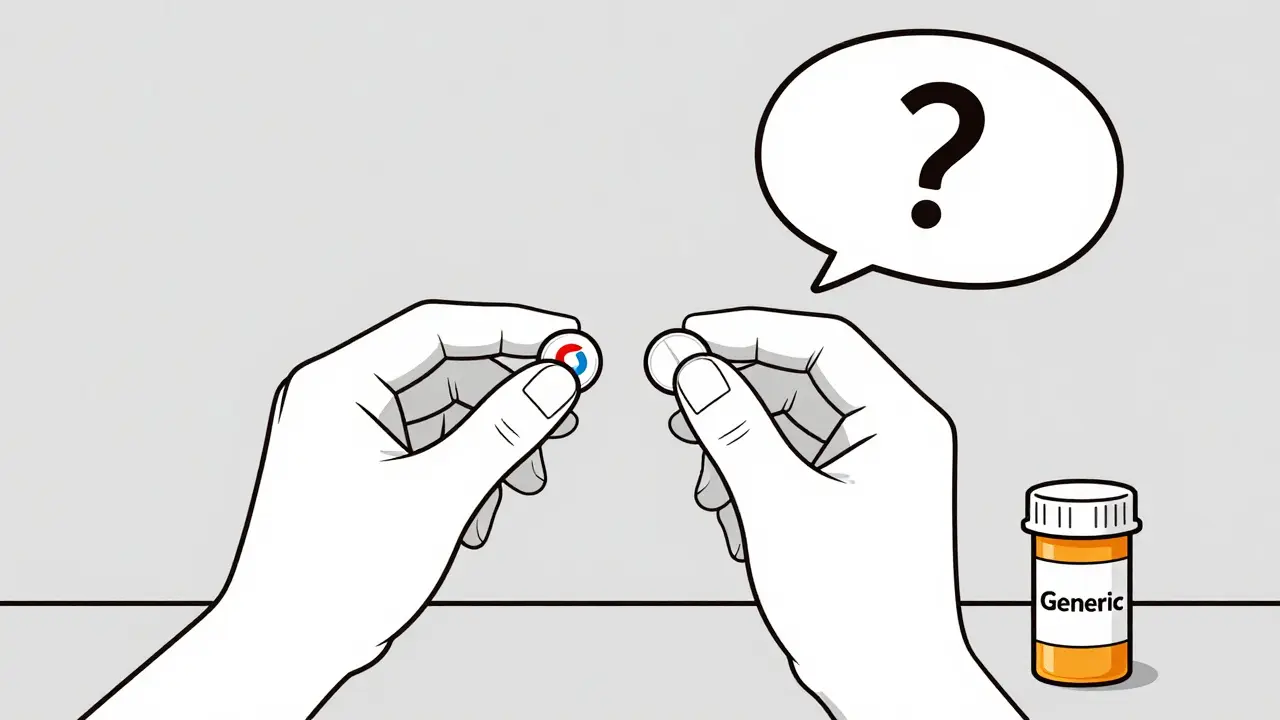

Generic drugs are legally required to contain the same active ingredient, in the same strength, as the brand-name version. The FDA says they’re bioequivalent: meaning they work the same way in the body. But that doesn’t mean patients believe it. Studies show that up to 59% of patients who switch to generics report feeling like they’re getting a lesser product. It’s not about chemistry-it’s about psychology. The color, shape, size, or even the brand name printed on the pill can trigger doubt. A patient who’s been on brand-name Synthroid for years might panic when handed a white oval pill with a different imprint. They remember how they felt on the original. Now, they worry the generic isn’t doing the same job. This isn’t just in the U.S. In Greece, 70% of patients trusted generics when their doctor explained they were safe. In Saudi Arabia, only 45% believed generics matched international brands. Culture, education, and past experience shape belief more than data ever could.How We Measure Satisfaction-And Why It’s Flawed

Researchers have built dozens of tools to measure patient satisfaction with generics. One of the most common is the Generic Drug Satisfaction Questionnaire (GDSQ), which asks 12 questions about effectiveness, convenience, and side effects. It’s reliable-Cronbach’s alpha above 0.8 in most studies. But here’s the catch: people answer differently when they know they’re being studied. The Hawthorne effect shows up here. When patients realize they’re part of a survey, their satisfaction scores jump by nearly 19%. That’s not because they suddenly love generics-it’s because they want to give the "right" answer. Meanwhile, real-world data tells a different story. On Reddit, thousands of patients write about switching from brand to generic and experiencing weird side effects-especially with antidepressants and seizure meds. And then there’s the method. Discrete choice experiments (DCE) ask patients to pick between hypothetical options. One study found 72% of patients were dissatisfied with at least one generic they’d tried. But when researchers used machine learning to analyze actual behavior-like refill patterns and pharmacy records-they found 70% of patients in Greece actually preferred generics when their doctor recommended them. So which is real? The survey answers? Or the refill rates? Both. Satisfaction isn’t one thing. It’s a mix of what people say, what they feel, and what they do.Medication Class Matters More Than You Think

Not all generics are treated the same. Antibiotics? 85% satisfaction. Patients don’t care if it’s a generic amoxicillin-they just want the infection gone. But antiepileptics? Only 69% satisfaction. Why? Because even small changes in blood levels can trigger seizures. Patients aren’t being irrational-they’re scared. Same with thyroid meds. Levothyroxine is one of the most prescribed generics in the world. But it has a narrow therapeutic index: meaning tiny differences in absorption can throw off hormone levels. Patients who switched from Synthroid to generic and noticed their TSH levels fluctuating aren’t imagining things. Some studies show 15-20% of these patients experience measurable changes in lab values after switching. And statins? People report feeling less energy on generic atorvastatin-even when cholesterol numbers are identical. That’s brand psychology in action. The brand name carries a promise: "This is the one that worked for me." The generic? Just a cheaper version.

Who Influences Patient Trust the Most?

Doctors. Pharmacists. Not ads. Not websites. Not influencers. When a physician says, "This generic is exactly the same," and explains the FDA’s 80-125% bioequivalence range, patient satisfaction jumps by 34%. That’s huge. But too often, providers skip the explanation. They assume the patient knows. Or they don’t have time. Or they believe the science speaks for itself. Pharmacists are even more critical. In Australia, where pharmacists routinely counsel patients on generic switches, satisfaction rates are 18% higher than in the U.S. Why? Because the pharmacist says, "This is the same medicine, just without the marketing cost. You’ll save $36 this month. And no, it won’t change how you feel." That kind of clarity changes behavior. Patients who get a simple, confident explanation are far more likely to stick with the generic.Cost Isn’t the Only Driver-But It’s the Biggest One

Yes, generics save money. In the U.S., they make up 91% of prescriptions but only 17% of drug spending. That’s over $300 billion saved annually. But money alone doesn’t guarantee satisfaction. Patients who can’t afford the brand? They’ll take the generic, even if they’re skeptical. But they’re also more likely to skip doses if they think it’s "weaker." That’s adherence breaking down-not because the drug fails, but because the belief fails. One patient on HealthUnlocked wrote: "Generic lisinopril works exactly the same as Prinivil but costs $4 instead of $40." That’s the sweet spot: no difference in effect, massive difference in cost. That’s when satisfaction soars. But if a patient has to pay $10 out-of-pocket for a brand and $2 for a generic, and still feels worse on the generic? The cost savings don’t matter. The feeling does.

What’s Changing in 2025?

The FDA just launched GDUFA III’s Patient Perception Initiative-a $15.7 million project to build smarter satisfaction tools. They’re using AI to scan social media posts in 28 languages, looking for patterns in how people talk about generics. Are they saying "I feel sluggish"? "My heart races"? "It doesn’t work like before"? Meanwhile, the Mayo Clinic is testing something new: pharmacogenomic satisfaction assessments. Instead of asking, "Do you trust generics?" they’re asking, "Based on your genes, how do you metabolize this drug?" This approach predicts satisfaction 29% better than old methods. It’s no longer enough to say, "It’s the same medicine." We need to say, "Here’s why your body will respond the same way. Here’s what to watch for. And here’s what to do if you notice a change."What Patients Really Want

They want to know:- Is this really the same?

- Will I feel different?

- What if something goes wrong?

- Who do I call if I’m not sure?

13 Comments