Ever picked up your prescription and been shocked that your generic drug cost more than the brand-name version? You’re not alone. It’s 2025, and millions of Australians and Americans are paying higher copays for generics that are chemically identical to cheaper versions - all because of how insurance companies sort drugs into tiers.

What Are Tiered Copays?

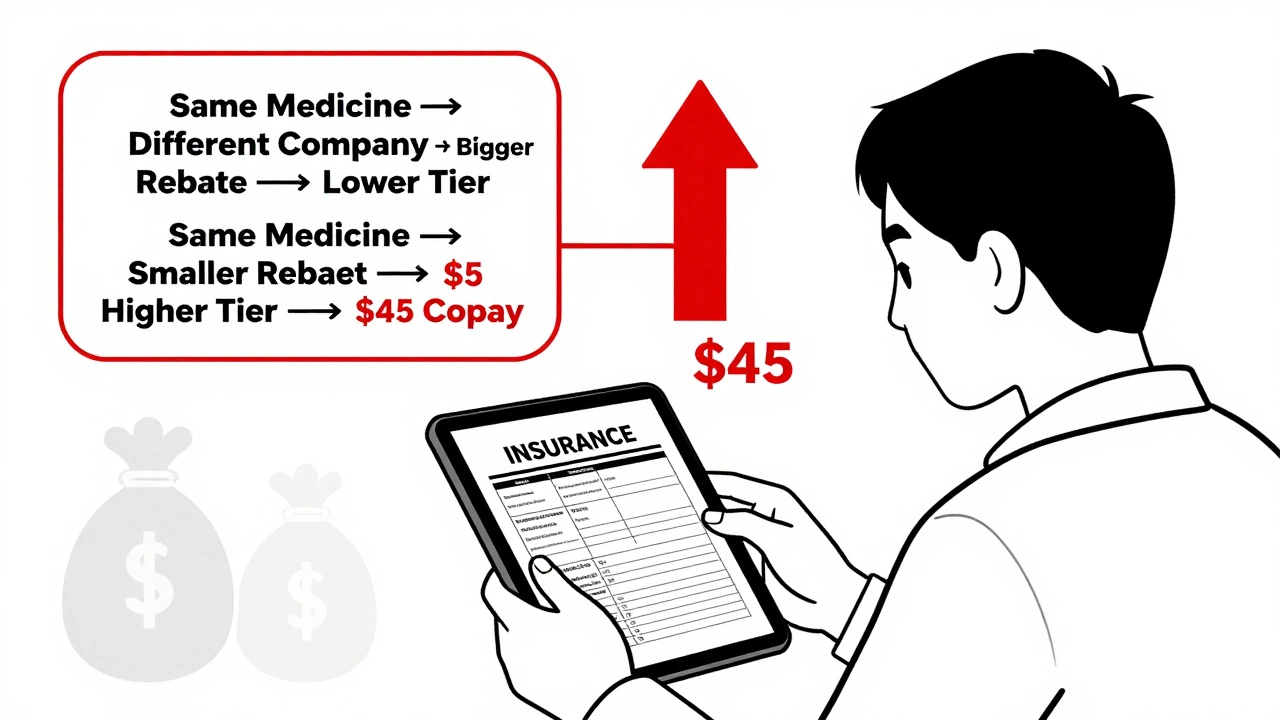

Tiered copays are how health plans make you pay different amounts for different drugs. Instead of one flat fee, your plan splits medications into levels - usually 4 or 5 tiers. The lower the tier, the less you pay. Tier 1 is usually for the cheapest generics. Tier 2 might be for other generics or preferred brands. Tier 3 and above? That’s where things get expensive - often for non-preferred brands or specialty drugs. But here’s the catch: not all generics are in Tier 1. Some generics, even if they’re the exact same medicine as the $5 version, can sit in Tier 2 or even Tier 3. That means you could pay $45 instead of $5 for the same pill.Why Would a Generic Be in a Higher Tier?

It’s not about quality. It’s not about effectiveness. It’s about money - specifically, the deals insurance companies and pharmacy benefit managers (PBMs) strike with drug makers. PBMs like CVS Caremark, Express Scripts, and OptumRx negotiate rebates with manufacturers. If a generic drug maker gives a bigger discount, their version gets placed in Tier 1. If they don’t, even if the drug is identical, it gets bumped up. That’s why two bottles of levothyroxine - the same hormone, made by two different companies - can cost $5 and $45 at the same pharmacy. In fact, about 12-18% of generic drugs are classified as specialty drugs and placed in Tier 4 or 5, not because they’re complex, but because they cost more than $600 per month to make. That pushes them into higher tiers even though they’re still generics.How This Confuses Patients

Patients assume generics are all the same - and they are, medically speaking. But insurers treat them like different products. You might get your usual prescription filled, only to find out your copay jumped because the pharmacy switched to a different generic version. No one told you. No one asked you. One patient in Sydney, on Reddit’s health insurance forum, wrote: “My thyroid med went from $5 to $45 overnight. My doctor said all generics are the same. So why am I paying more?” A 2023 survey found that 41% of insured adults in the U.S. had this exact experience. And 68% said their insurer gave no clear reason why. This isn’t just confusing - it’s dangerous. When people see a big price jump, they skip doses or stop taking the drug entirely. Studies show that when a drug moves from Tier 2 to Tier 3, adherence drops by over 7%. For someone with high blood pressure or diabetes, that’s a real health risk.

How Insurers Justify It

Insurers say tiered systems help control costs. And they’re right - they’ve saved billions. By nudging people toward cheaper drugs, they reduce overall spending. But the system doesn’t care if you’re getting the best drug for you. It only cares about which drug gives them the biggest rebate. Dr. Aaron Kesselheim from Harvard put it bluntly: “Tiering generics differently undermines the whole point of generics. It creates financial barriers that have nothing to do with medicine.” The truth? It’s a business model disguised as cost-saving. PBMs earn money by steering prescriptions to drugs they get the highest kickbacks on - even if those drugs cost patients more.What You Can Do

You don’t have to accept this. Here’s how to fight back:- Check your formulary - Every plan publishes a list of drugs and their tiers. Look it up on your insurer’s website. Update it every October, when plans change.

- Ask your pharmacist - If your copay jumped, ask: “Is there a preferred generic available?” They often know which version is cheaper and can switch it without a new prescription.

- Request a therapeutic interchange - This is a formal request from your doctor to switch you to a lower-tier drug. Success rate? Around 63%.

- Use GoodRx or SmithRx - These apps show you cash prices and tiered copays side by side. Sometimes paying cash is cheaper than your copay.

- Apply for manufacturer assistance - Many drug makers offer coupons or free programs for high-cost generics. You’d be surprised how much you can save.

Specialty Generics Are the Biggest Problem

Some generics aren’t just pills - they’re complex biologics. Drugs like adalimumab (used for rheumatoid arthritis) now have multiple generic versions. These are called biosimilars. But insurers treat them like luxury items. You might pay 25-40% coinsurance on a $10,000 monthly drug. That’s $2,500-$4,000 out of pocket. Even if it’s a generic. Even if it’s the same as the $1,500 version. And insurers are getting worse. In 2024, Express Scripts moved 87 generic drugs to higher tiers because their rebate deals expired. UnitedHealthcare started putting common generics like atorvastatin (a cholesterol drug) into $0 tiers - but only the ones they negotiated the best deals on. The rest? Tier 2, $10.What’s Changing in 2025?

The U.S. Inflation Reduction Act caps out-of-pocket drug costs at $2,000 per year for Medicare Part D - starting January 2025. That’s huge. But it doesn’t change tier structures. It just puts a ceiling on what you pay. Some lawmakers are pushing to ban tiering of generics altogether. The bipartisan Prescription Drug Pricing Reduction Act could force insurers to treat all generics the same. But so far, PBMs have blocked it. In Australia, the Pharmaceutical Benefits Scheme (PBS) doesn’t use tiered copays. All PBS-listed generics cost the same - $31.30 for concession card holders, $30.30 for others. No tiers. No surprises. Just fairness.Bottom Line

Your generic isn’t more expensive because it’s better. It’s more expensive because the system rewards the company that paid the biggest bribe - I mean, rebate. The good news? You have power. You can ask questions. You can switch versions. You can use tools to find the lowest price. And you can push back when your insurer gives you a vague answer. Don’t let a bureaucratic pricing game keep you from your medicine. Know your tiers. Know your rights. And never assume a generic is cheap - check it first.Why is my generic drug more expensive than the brand name?

It’s not about the drug - it’s about the deal. Your insurer has a contract with one generic manufacturer that gives them a big rebate, so they put that version in Tier 1. Other identical generics get placed in higher tiers because their maker didn’t offer a big enough discount. The medicine is the same. The price isn’t.

Can my pharmacist switch me to a cheaper generic without asking me?

Yes, in many cases. Pharmacists are allowed to substitute a preferred generic unless your doctor writes "dispense as written" on the prescription. That’s called automatic substitution. It’s legal, but it can lead to unexpected price hikes. Always check your receipt.

How do I find out which tier my drug is on?

Log into your insurance plan’s website and look for the formulary or drug list. Most plans update this every October. You can also call customer service and ask for the tier of your specific drug by name and strength. Third-party tools like GoodRx and SmithRx also show tier info alongside cash prices.

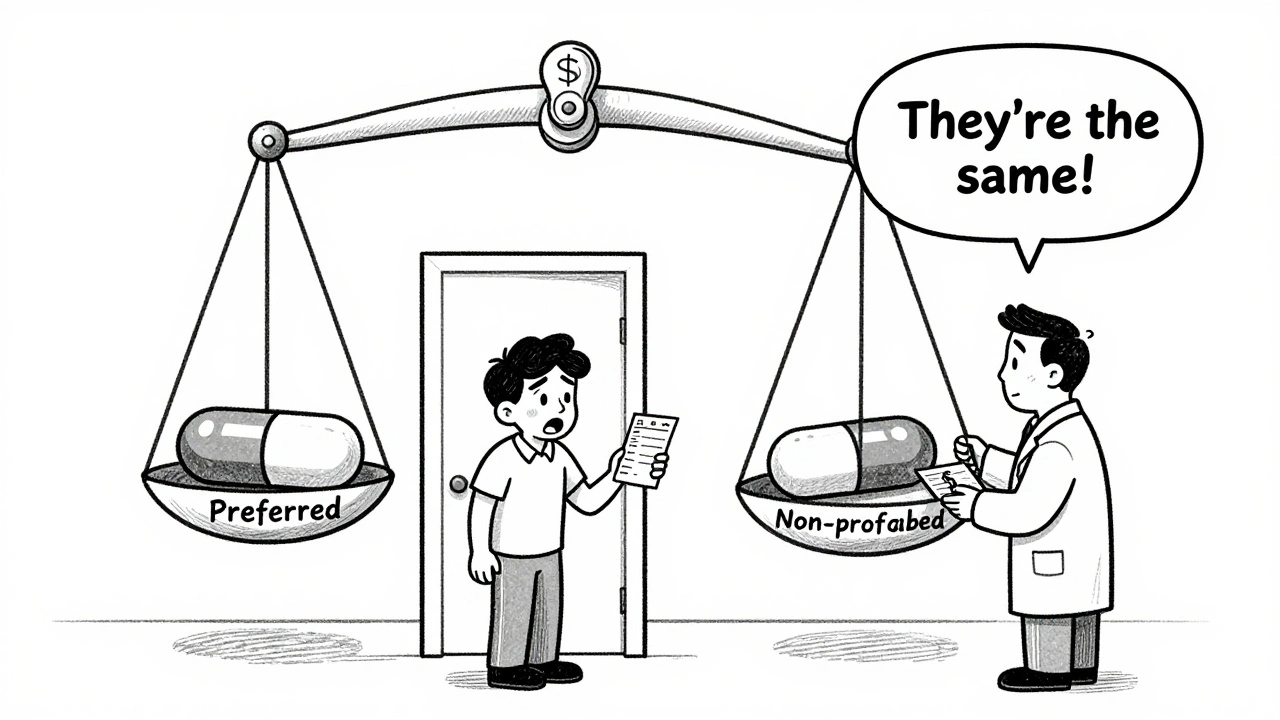

What’s the difference between preferred and non-preferred generics?

There’s no medical difference. "Preferred" means the manufacturer gave the insurer a better rebate. "Non-preferred" means they didn’t. Both drugs have the same active ingredient, dosage, and effect. The only difference is the price you pay.

Can I appeal if my drug moves to a higher tier?

Yes. Most plans have an exceptions process. Your doctor can submit a form saying the drug is medically necessary - even if it’s in a higher tier. If approved, your copay drops to the lower tier rate. Success rates are around 60-70% for documented medical reasons.

Are there any new laws to stop this practice?

In the U.S., the Inflation Reduction Act caps out-of-pocket drug costs at $2,000 a year for Medicare patients starting in 2025, but it doesn’t ban tiering. A proposed bill called the Prescription Drug Pricing Reduction Act would require insurers to treat all generics the same - but it hasn’t passed yet. Australia’s PBS already does this: all listed generics cost the same, no tiers.

What should I do if my drug suddenly costs more?

First, don’t stop taking it. Contact your pharmacist and ask if a cheaper generic is available. Then, ask your doctor to request a therapeutic interchange. Check GoodRx for cash prices - sometimes paying outright is cheaper. And if you’re on Medicare, you can apply for a low-income subsidy to reduce your costs.

10 Comments