For years, Medicare couldn’t negotiate drug prices at all. That changed in 2022, when the Inflation Reduction Act gave the government the power to step in and cut prices for the most expensive single-source medications. Starting January 1, 2026, the first 10 drugs - including blood thinners like Eliquis and diabetes meds like Jardiance - will see price drops of 38% to 79% compared to what they cost in 2022. This isn’t a small tweak. It’s the biggest shift in how Medicare pays for drugs since Part D launched in 2006.

What Exactly Is Being Negotiated?

The new program doesn’t touch every drug. Only ones that meet three strict rules: they’re single-source (no generics or biosimilars), they cost Medicare more than $100 million a year, and they’ve been on the market for at least 7 years (or 11 for biologics). That means newer, high-cost drugs like those for rare diseases won’t be touched yet. But the big ones - the ones millions of seniors rely on - are now fair game.CMS, the agency that runs Medicare, picks the drugs each year. In 2026, it’s 10 drugs. In 2027, it jumps to 15. By 2029, it’s 20 drugs annually. Each one has to be a top spender. Eliquis alone cost Medicare $6.3 billion in 2022. That’s why it was first on the list.

The goal isn’t to make drugs cheap. It’s to make them fair. Before this law, Medicare paid whatever drugmakers asked. Private insurers got discounts through rebates, but Medicare didn’t. Now, CMS sets a “Maximum Fair Price” - a number based on what the drug actually sells for in the market, after rebates, and how much it costs compared to similar treatments. If the manufacturer doesn’t agree, they can walk away - but then Medicare won’t cover their drug at all.

How the Negotiation Process Actually Works

It’s not a back-and-forth over coffee. It’s a tightly timed, legally defined process.On February 1, 2024, CMS sent its first offer to each of the 10 drugmakers. That offer wasn’t random. It was built using real data: how many people use the drug, what alternatives exist, how much it costs in other countries, and how much Medicare spent on it last year. Manufacturers had exactly 30 days to respond with a counteroffer.

Then came three formal negotiation meetings - held between April and July 2024. CMS didn’t budge wildly. They stuck to their numbers, but they listened. Five of the 10 companies agreed during these meetings. The other five submitted final written offers by August 1, 2024. No more back-and-forth. No extensions. Deadline was absolute.

The final prices? They’re not just lower. They’re capped. The new price can’t be higher than either:

- The average price Medicare paid last year, after all rebates and discounts, or

- A percentage of the drug’s average price to hospitals and pharmacies (called non-FAMP), adjusted for inflation.

That’s why discounts ranged from 38% to 79%. For some drugs, the old price was wildly inflated. For others, it was closer to fair. The system forces manufacturers to justify their pricing - or lose access to 65 million Medicare beneficiaries.

What This Means for You as a Beneficiary

If you’re on Medicare and take one of these 10 drugs, you’ll see lower out-of-pocket costs starting January 1, 2026. But it’s not automatic.First, your Part D plan must update its formulary by October 15, 2025. If your drug is on the list, your plan will replace the old price with the new, lower one. You won’t get a letter saying, “Your insulin is now cheaper.” But your co-pay will drop. For some, that could mean saving $200 to $600 a year.

People in the “donut hole” - the coverage gap where you pay 25% of the drug’s cost - will benefit the most. Before, they paid the full list price. Now, they pay the new, negotiated price. That’s a huge win.

Those in the catastrophic phase - where you pay 5% or a small copay - might not see as big a change. But even small savings add up over time. And if you take more than one of these drugs? The savings stack.

What About Private Insurance?

You might wonder: “Does this affect me if I’m not on Medicare?”Yes, it does - indirectly.

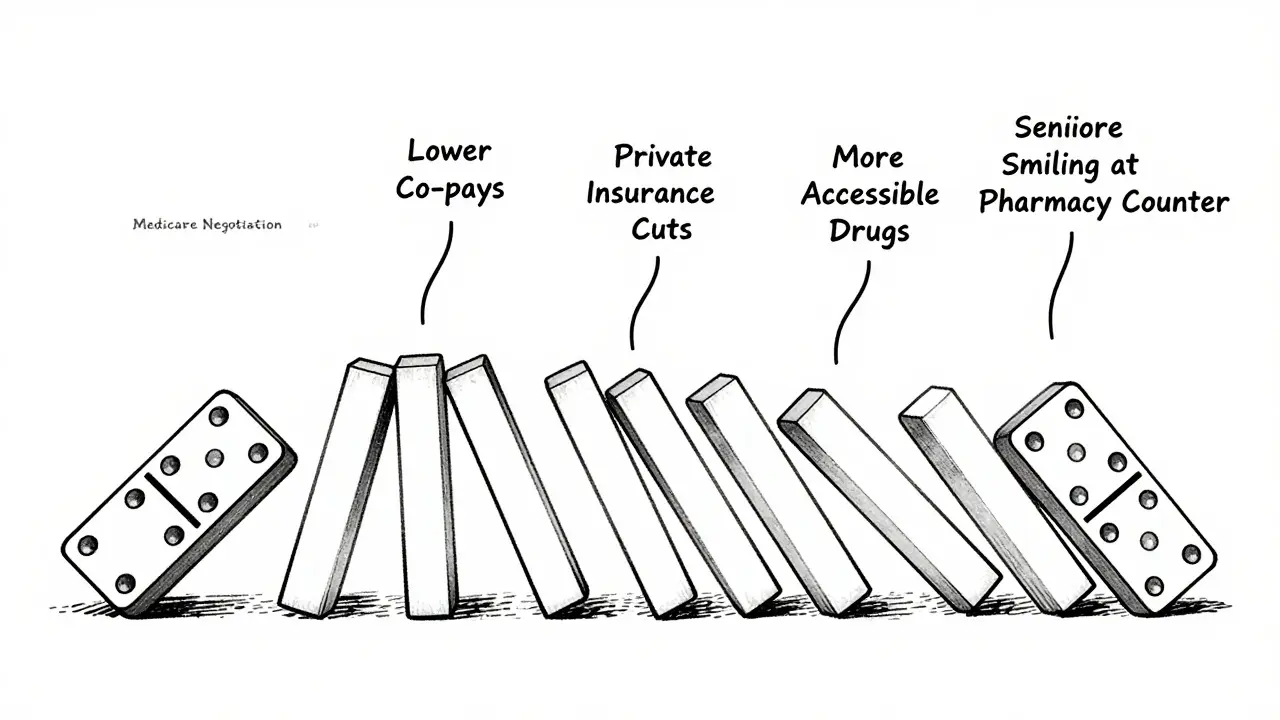

Drugmakers don’t want to charge Medicare one price and private insurers another. That’s messy and risky. So, many companies are already lowering prices for commercial plans to match the Medicare rate. The Pharmaceutical Care Management Association estimates private insurers could save $200-250 billion over 10 years because of this.

It’s called the “spillover effect.” When the biggest buyer in the country - Medicare - gets a better deal, everyone else gets pulled down with it. That’s why pharmacies and insurers are already updating their pricing systems ahead of 2026.

Why Some Companies Are Fighting Back

Not everyone’s happy. Four of the 10 drugmakers sued the government, claiming the negotiation process violates the Constitution. They argued the government is “taking” their property without fair compensation.On August 2, 2024, a federal judge dismissed all four lawsuits. The ruling said Congress has the right to set drug prices for public programs. The companies are appealing. But even if they win on appeal, the new prices still take effect January 1, 2026 - unless a higher court blocks it.

Meanwhile, PhRMA, the drug industry’s main lobby, claims the program will hurt innovation. They say drugmakers will cut R&D spending because profits will drop. But the Office of Management and Budget says those claims are exaggerated. Real-world data from the VA - which has negotiated prices for decades - shows innovation didn’t slow down. In fact, the VA gets the same new drugs as private insurers, just at lower prices.

What’s Coming Next

The 2027 list of 15 drugs was announced in January 2024. That includes Farxiga, Stelara, and others used for arthritis, heart failure, and autoimmune diseases. Negotiations for those will end in November 2025, with prices taking effect January 1, 2027.By 2028, the program expands to Part B drugs - the ones you get in a doctor’s office, like infusions and injections. That’s a bigger challenge. Doctors get paid a percentage of the drug’s cost. If the drug price drops, so does their reimbursement. That’s why the American Medical Association is pushing for adjustments to how doctors are paid under the new system.

There’s also talk of lowering the eligibility window. Right now, a drug must be 7 years old. Some lawmakers want to cut that to 5 years. That would open up dozens more high-cost drugs to negotiation sooner.

What You Should Do Now

If you take a high-cost medication:- Check if it’s on the 2026 list: Eliquis, Jardiance, Xarelto, Farxiga, Metformin, Synthroid, Lantus, Humira, Enbrel, and Repatha.

- Call your pharmacy or Part D plan after October 1, 2025, and ask if your drug’s price has been updated.

- Don’t assume your co-pay won’t change. Even if your plan says “no change,” the negotiated price might lower it anyway.

- If you’re on a high-deductible plan, those savings could mean the difference between affording your meds or skipping doses.

And if you’re not on Medicare yet? This sets a precedent. If the government can negotiate prices for seniors, why not for everyone? That’s the next conversation - and it’s already starting.

Will my Medicare Part D premiums go down because of drug price negotiations?

Not directly. Premiums are set by your plan and based on overall costs, not just drug prices. But lower drug spending means plans may raise premiums more slowly in future years. The biggest immediate benefit is lower out-of-pocket costs at the pharmacy, not lower monthly premiums.

Can I get these lower prices before January 1, 2026?

No. The negotiated prices only take effect on January 1, 2026. Any pharmacy or insurer offering a discount before then is likely running a separate promotion, not the official Medicare price. Don’t trust unofficial claims - wait for your plan’s official notice.

What if my drug is not on the list but still costs too much?

You can ask your plan for a formulary exception. If your doctor says a non-negotiated drug is medically necessary, your plan must review it. You can also look into patient assistance programs from drugmakers or nonprofit organizations like NeedyMeds. Some states also have prescription assistance programs.

Will this affect my access to my current medication?

No. The law requires Medicare to continue covering all drugs on the list - just at a lower price. Your plan can’t drop your drug just because the price changed. If your plan tries to replace your drug with a cheaper alternative without your doctor’s approval, you can file an appeal.

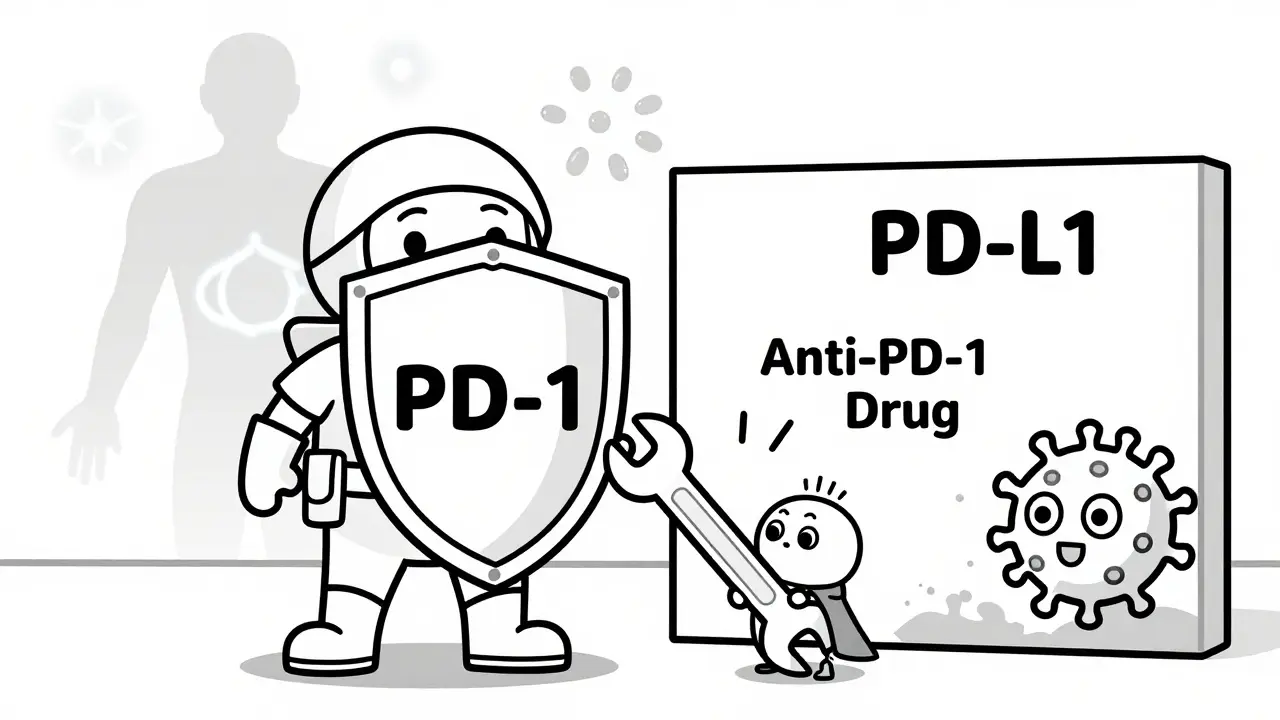

Are biosimilars affected by this program?

Not directly. The program only applies to drugs with no generic or biosimilar competition. But biosimilars are growing. As more of them enter the market, fewer drugs will be eligible for negotiation - which is why the government is also encouraging biosimilar use. If a biosimilar exists, the original drug won’t be selected for negotiation.

13 Comments